Is a Sauna HSA Eligible?

With TrueMed, you can purchase our saunas with your HSA/FSA at a discounted price!

Plenty of studies have shown the multiple benefits of saunas both on our mental and physical health. Regular sauna use has been linked to improved cardiovascular health, reduced stress levels, and enhanced relaxation.

Recognizing these profound health benefits underscores the importance of making sauna sessions accessible and affordable to as many people as possible. Having a sauna at home eliminates the need for costly spa visits and allows for a more consistent and personal wellness routine. It’s an investment in your health that pays dividends in both the short and long term.

We know that while it’s a fantastic investment, it can be costly. That’s why we’re thrilled to announce our partnership with TrueMed, empowering you to use your health savings account (HSA) or flexible spending account (FSA) to purchase our saunas. This means you maximize your savings as well as your well-being.

What’s an HSA?

If you don’t have one yet, simply put, an HSA, or health savings account, is a tax-advantaged account that lets you save money to pay for qualified health and medical expenses.

Contributions to an HSA reduce your taxable income, and the funds in the account grow tax-free. The money in health savings accounts can be used for any qualified medical expense like copays, prescriptions, dental care, and more without paying taxes on it.

Aside from being tax-free, HSA accounts have no expiration dates and can be used on your spouse and dependents. You also keep your HSA even if you change jobs or retire.

|

Tip: To contribute to an HSA, you’ll typically need to be enrolled in an HSA-eligible plan. Eligible plans are available through the Health Insurance Marketplace and Small Business Health Options Program (SHOP). |

What’s an FSA?

An FSA, or flexible spending account, is a little similar to an HSA. While HSAs are owned by you, FSAs are mostly offered by employers. FSA funds allow employees to set aside pre-tax dollars for eligible medical expenses like insurance copayments, deductibles, prescription drugs, and medical devices.

You can put part of your paycheck into this account before taxes are taken out, which means you pay less tax.

FSA funds generally need to be used within a fiscal year. Any money left in your account will be lost after the grace period.

What’s the Difference between FSA and HSA?

As of February 2024, the table below shows the difference between both accounts:

|

Feature |

Health Savings Account (HSA) |

Flexible Spending Account (FSA) |

|

Eligibility |

Must be enrolled in an HDHP |

Available with any type of health insurance through an employer |

|

Contributions (2024) |

Pre-tax $4,150 limit for individuals and $8,300 for families |

Pre-tax through payroll deductions $3,200 individual limit |

|

Roll Over |

Funds roll over indefinitely |

“Use it or lose it” policy—funds must be used by the end of the plan year or before grace period |

|

Ownership |

Owned by the individual; can be taken from job to job |

Owned by the employer; not portable if you change jobs |

|

Investment Options |

Funds can be invested, potentially increasing in value over time |

Generally, no investment options; acts more like a spending account |

|

Qualified Expenses |

Available for a wide range of medical expenses, including future medical costs |

Must be used for current year medical expenses; limited carryover options |

|

Tax Advantages |

Contributions, investment growth, and withdrawals for qualified medical expenses are tax-free |

Contributions are pre-tax, reducing taxable income |

Details above come from the Internal Revenue Services (IRS). As regulations and policies can evolve, we recommend visiting the IRS website regularly to stay updated on any changes that might affect your decisions or actions.

|

Have an FSA? Don’t put more money than what you think you’ll spend on qualified medical expenses for FSA funds. |

Why Are Our Saunas Eligible for HSA/FSA?

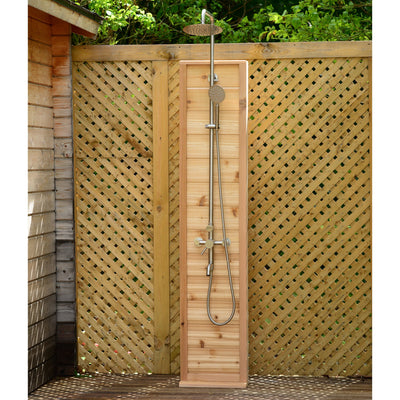

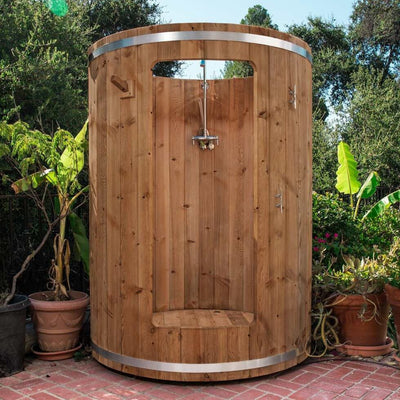

Wellness products—a traditional sauna, cold plunge bath, steam room, etc.—are increasingly becoming recognized for their benefits on a person’s physical and mental health. They can be instrumental in managing and treating chronic conditions.

With Truemed, our customers can effectively use their HSA/FSA funds to purchase a sauna.

The key to using your HSA/FSA funds for a sauna purchase is obtaining a letter of medical necessity (LMN). This letter justifies your sauna as a necessary medical expense for treating or alleviating a specific condition.

A letter of medical necessity is essentially a recommendation from a healthcare provider that outlines your medical condition and explains why a sauna is essential for your treatment. HSAs and FSAs are regulated by the IRS, which only allows these funds to be used for eligible medical expenses—unqualified expenses will get a 20% tax penalty.

Simply put, the process with Truemed at Select Saunas makes it straightforward for you to use your HSA or FSA. When you’re ready to buy a sauna from us, you’ll fill out a form to determine eligibility.

Based on your responses, eligibility for an LMN is determined. If eligible, you’ll receive your LMN. You can now use your HSA or FSA funds toward your purchase of our saunas.

What Are the Benefits of Buying a Sauna with HSA/FSA?

By using your HSA or FSA funds, you can make tax-advantaged purchases, resulting in significant savings of up to 30–40%. Saunas are officially considered as eligible medical expenses, recognized for their proven benefits to your mental and physical health.

To reiterate, saunas, whether traditional or infrared saunas, support improved circulation, immune system support, fatigue reduction, stress relief, and detoxification.

These saunas warm the body, potentially offering cardiovascular fitness benefits equivalent to low-intensity exercises, pain relief from various conditions, skin detoxification, and even improved skin tone due to increased collagen production.

How to Use Your HSA/FSA for Your Sauna Purchase

If your HSA/FSA debit card does not have sufficient funds for the full purchase amount:

- On the product page, click on the “Get pre-qualified” link. Fill in the details.

- Once healthcare providers we’ve partnered with determine eligibility and you are approved, you will be issued an LMN specifically for your purchase.

- Once you receive your LMN, use your personal credit card or PayPal to complete the purchase on our website.

- After your purchase, follow the reimbursement instructions sent to you to submit your receipts and LMN to your HSA/FSA provider.

If your HSA/FSA debit card has sufficient funds for the full purchase amount:

- Add items to cart and check out.

Select TrueMed - Pay with HSA/FSA as payment option

- Eligible to US residents only

- Eligible only for use with your HSA or FSA card

- Follow the steps on TrueMed and enter your HSA or FSA card details.

- Fill in a short and secure eligibility form.

- Complete your purchase!

- Please reach out to us if you have any questions regarding HSA/FSA sauna purchases.

Maximize Your Savings as Well as Your Well-Being

Investing in your health doesn’t need to gouge a hole in your wallet. We believe in the transformative power of saunas for both mental and physical health and strive to make them accessible to everyone.

By making our saunas eligible for purchase with HSAs or FSAs funds, we aim to make them more financially viable for you.

Select Saunas offers a wide variety of world-class traditional and infrared saunas you can enjoy in the comfort of your home. Experience the benefits of heat therapy with your own private sauna today!